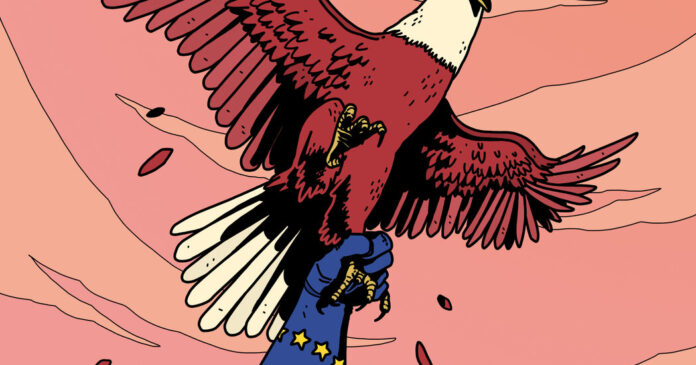

Hey there, my lovely readers! So, apparently Europe has landed a fancy new edge cancer detection technology, but the EU has decided to call things off and unwind the merger. Hmm, interesting move, Europe. The FTC hasn’t said much about this, which is surprising since they are all about power grabbing. But hey, maybe the EU can achieve results more in line with the FTC’s agenda than the FTC ever could. Sounds like a win-win to me!

But hold on to your hats, folks, because it turns out that Europe’s power grab doesn’t stop there. The SEC has also hopped on the bandwagon and proposed that public companies should share emissions data and disclose climate risks, even if it’s irrelevant from an investment perspective – all thanks to EU requirements. Wow, SEC, it looks like you’re taking a page out of Europe’s book and attempting to import some energy and climate policy. Who knew Europe would become the new trendsetter?

And the fun doesn’t stop there, my dear readers. The Federal Reserve and other financial regulators are constantly under pressure from members of Congress and international bodies to import sweeping EU regulations regarding banking, insurance, and asset management. But let’s be real, our financial regulators have no business setting energy and climate policies, especially not by deferring to the Europeans. Sorry, Europe, but you can keep your regulatory harmonization buzzwords to yourselves.

Now, if these instances were just one-time things, we could all just laugh it off and move on. Unfortunately, that’s not the case. It seems like our regulators are always deferring to foreign authorities instead of doing their jobs properly. Come on, guys, we have laws to follow here! Let’s start considering domestic consequences before we blindly follow Europe’s lead.

Serious News: nytimes